Our loos flush and water comes out of our taps. In that sense, the water industry in England and Wales works. In just about every other way, it’s a mess.

The most visible sign of that mess comes after those loos have flushed. Last year England’s privatised water firms released raw sewage for a total of 3.6m hours, more than double the amount recorded the year before.

Millions of customers, surfers and bathers have joined a chorus that former pop star Feargal Sharkey has been singing for years – that the sector is a “chaotic shambles”.

It’s not just our rivers, lakes and coastlines. Some communities have been told to boil tap water to make it safe, others have seen their water supplies cut off for days or even weeks.

Environment Secretary Steve Reed told the BBC some parts of the country could face a drinking water shortage by the 2030s and plans to build new homes have been jeopardised by water supply problems.

Faith in these companies has never been lower and it’s not hard to see why.

There are some common denominators causing stress on the system that will take radical reform to tackle. The government knows this – which is why it has just announced a major new commission to conduct the biggest review of the sector since privatisation 35 years ago.

The independent commission will be led by former Bank of England Deputy Governor Sir Jon Cunliffe and will report back with recommendations next June. Options on the table include the reform or abolition of the main regulator Ofwat.

To critics like Sharkey, the former lead singer of the Undertones who nowadays is vocal about the state of UK’s rivers, it’s an admission that the privatisation of essential monopolies has been a failure. Recently, he described this as “possibly the greatest organised ripoff perpetrated on the British people”.

So how did we get here, how might it be fixed and what will that mean for customers and their bills?

Drowning in debt

Reflecting on water privatisation in her memoirs, Margaret Thatcher wrote that “the rain may come from the Almighty but he did not send the pipes, plumbing and engineering to go with it”.

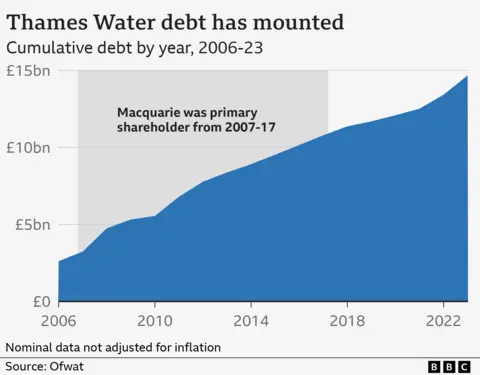

When her government privatised the water companies in the late 1980s, they were debt free. Today they have a combined £60bn in debt.

There is nothing intrinsically wrong with debt. It can be a cost-efficient way to finance investment in an industry that lenders have been very happy to lend to.

And it’s easy to see why they’ve been so happy to lend to it. Water companies have guaranteed and rising income from customers, who can’t go anywhere else for something they will always need. Regional monopolies of an essential service that provides a guaranteed income have always been considered a safe bet.

The other attraction for shareholders in water companies, like others, is that the cost of the loan repayments can be deducted from earnings to reduce reported profit and therefore their tax bill.

Some shareholders, not all, have pushed this too far and loaded an excessive amount of debt on water companies. That can backfire when the cost of that debt begins to rise – as we have seen over the last two years as interest rates rose to tackle the surge in inflation since 2022.

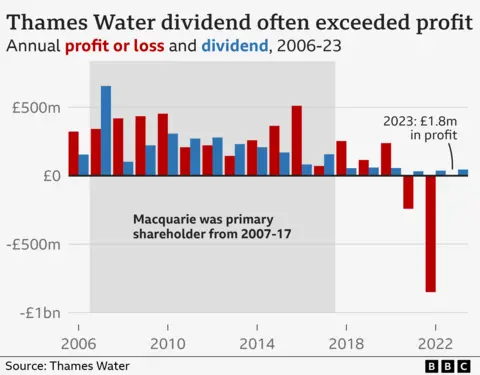

For example, during the 10 years that Australian investment firm Macquarie was Thames Water’s biggest shareholder from 2007 to 2017, debt rose from £2bn to £11bn, during which time Macquarie and the other investors did not inject any new cash or equity of their own.

In five years out of the 10 that Macquarie was a major shareholder in Thames Water, investors took out more money in dividends than the company made in profit and made up the shortfall by borrowing heavily while letting debt levels soar.

Thames Water now stands on the brink of bankruptcy with barely enough cash to last until the end of the year.

Macquarie sold its share of the company in 2017. Newer shareholders, including large domestic and foreign pension funds, recently cancelled an injection of £500m. They did so after they learned that Ofwat would not allow bill rises that the newer shareholders insisted were necessary if their investment was to earn a return for their own pensioners and shareholders.

In a statement, a spokesperson for Macquarie said: “We supported Thames Water as it delivered record levels of investment, which enabled the company to reduce leakage and pollution incidents while improving drinking water quality and security of supply. Much more needed to be done to upgrade its legacy infrastructure, but when we sold our final stake in 2017 the company was meeting all conditions set by the regulator and had an investment grade credit rating.”

Thames Water’s debt today stands at over £16bn and the cost of that debt is rising for the UK’s biggest water company, which one in four people in the UK rely on for their supply.

It is the most extreme example but other companies including Southern Water are in a similar debt-laden boat. Since 2021, Southern’s largest shareholder has happened to be Macquarie.

Greedy shareholders and bosses?

As a result of all this, there is a widespread belief among the public that investors and executives have sucked out money in dividends and pay that should have been invested in improving water firms’ infrastructure. The Liberal Democrats capitalised on this perception during this year’s general election, gaining dozens of seats after making the state of the reform of the industry one of their key campaign pledges.

According to Ofwat, water companies have paid out £52bn in dividends (£78bn in today’s money) since 1990. Many feel that was money that could have been spent helping to prevent sewage spills rather than ending up in investors pockets.

But over the same time frame water companies have invested £236bn, according to Water UK, which represents the sector.

Last year, it adds, the England and Wales water sector invested £9.2bn, which it says is the highest capital investment ever in a single year.

And it’s important to note that not all water companies are the same.

A few are well run, have manageable debts and have invested steadily in their infrastructure over the three decades since privatisation, while delivering dividends to the shareholders who have provided the capital required by a privatised model.

Regardless, lenders are now demanding higher rates from other water companies, too, as the whole sector appears a riskier bet.

The regulator Ofwat allowed this increase in debt to happen as for many years it did not consider that it had the requisite powers to dictate how companies chose to structure their finances.

Bad regulation

Which brings us neatly to the next factor in this slow-motion car crash – poor regulation.

Ofwat not only failed to police the levels of debt piling up on water company balance sheets. It has also been accused of getting its priorities wrong by putting too much emphasis on keeping bills low and not enough on encouraging investment.

In the years after the financial crisis, the cost of borrowing fell very sharply – one reason that companies loaded up on debt.

The regulator decided, with nudges from government, that cash-strapped customers needed bills to be kept as low as possible. In fact, bills rose less quickly than inflation – so in real terms were getting cheaper.

But that meant less money in real terms for investment.

Water industry expert John Earwaker, a director at the consultancy First Economics, has suggested that the rapid fall in financing costs could and should have made room for more investment while still keeping bill rises modest.

But regulators take their cue and their powers from government. There have been negative comparisons with the telecoms industry and its regulator Ofcom, which was prompted by the government to ensure things like fast broadband received adequate investment.

Climate and population change

It’s not just a matter of supply. Demand is an issue, too. The size of the population and its concentration in cities have both risen while the weather is getting wetter.

I recently went to see rusting pipes laid near Finsbury Park in London during Queen Victoria’s reign over 150 years ago being replaced with bright blue plastic ones.

When the old pipes were laid, the land above them was semi-rural. Today, water company engineers are working underneath housing estates with all the disruption and expense that entails.

In more recent history, population density in cities has gathered pace. In 1990, when water companies were being privatised, 45 million people lived in urban areas. Today that number is 58 million – and increase of nearly 30%.

Meanwhile, there has been a 9% increase in rainfall in the past 30 years compared to the 30 years before that, according to the Met Office, and six of the 10 wettest years since Queen Victoria was on the throne have been after 1998.

Heavier and more intense rainfall overwhelms ageing infrastructure like storm drains that then discharge sewage into nearby waterways. And replacing this infrastructure requires enormous investment.

Company incompetence

As Ofwat CEO David Black recently pointed out, many companies are often keen to blame everyone and everything but themselves for bad outcomes.

Two weeks ago, Ofwat announced fines of £168m for three water firms over a “catalogue of failures” in how they ran their sewage works, resulting in excessive spills from storm overflows.

Then, Mr Black told the BBC: “It is clear that companies need to change and that has to start with addressing issues of culture and leadership. Too often we hear that weather, third parties or external factors are blamed for shortcomings.”

Sewage discharges may have some external causes but effective monitoring, reporting, rising gripes about complaints handling and billing errors are hard bucks to pass.

Some executives privately complain they are in a doom loop. They can’t charge enough to invest what’s needed, the infrastructure fails and then they are fined – leaving them even less money to invest in the very things they were fined for.

How do we fix it?

That is the job Sir John Cunliffe is now charged with. In the coming six months he will hear evidence from customers, companies, engineers, climate scientists, environmental activists and many others.

The setting-up of the commission was welcomed by Water UK on behalf of the sector: “Our current system is not working and needs major reform,” a spokesperson said.

All options are on the table, according to the environment secretary, including the abolition of Ofwat, set up by Margaret Thatcher at the time of privatisation in 1989, and its replacement with a new regulator.

All options, that is, apart from renationalisation which many have called for. Free-market competition doesn’t work when you have no choice which pipe you get your water out of, some argue.

But Mr Reed, the environment secretary, is adamant that is not the solution: “It will cost taxpayers billions and take years during which time we won’t see more investment and the problems we see today will only get worse.”